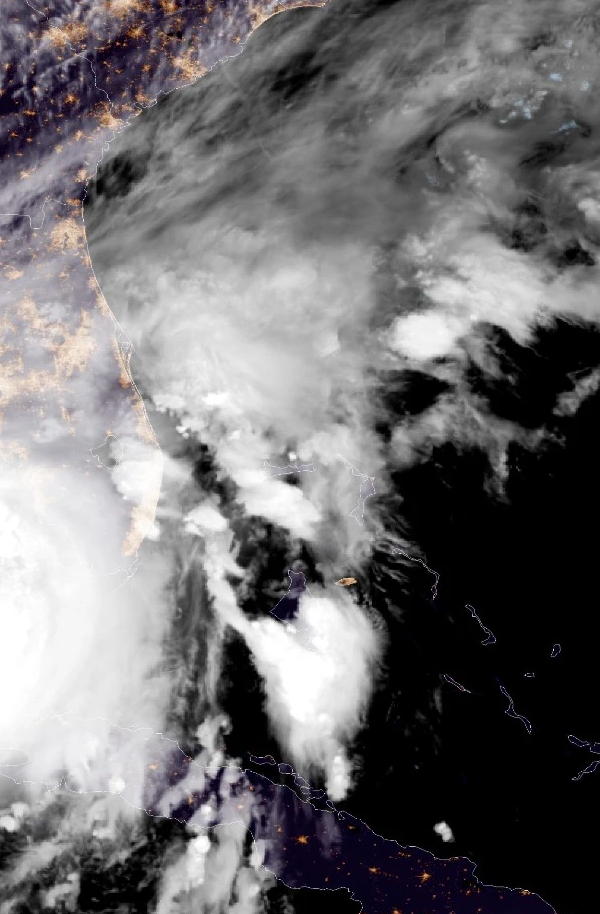

WE CAN HELP YOU WITH YOUR HURRICANE IAN CLAIM

On September 28th, 2022, Hurricane Ian made landfall across central Florida causing billions of dollars worth of property damage to thousands of homes and businesses. For many homeowners, this will be their first time filing an insurance claim and many do not know where to start. Here are some steps you can take to ensure that you are prepared to file a claim

1. Take pictures of the inside and outside of your property prior to the Storm

The adjuster sent by the insurance company will have never been inside your property before inspecting your property. Having pictures to show the way it looked before the storm will help prove what was actually damaged by the storm. This includes not only the photos of your ceilings, walls, floors, cabinets, and bathrooms, but also take photos of important items such as televisions, furniture, clothing, jewelry, etc. Great documentation is key when dealing with an insurance adjuster who is handling thousands of claims at a single time.

2. Review your insurance policy.

Understanding what you are covered for under your insurance policy will help set your expectations when it’s time to file an insurance claim. Your insurance policy has multiple exceptions and exclusions for what damage is or is not covered. Knowing what you are covered and not covered for will help you make a decision on what to take or leave inside of the home if you need to evacuate. Most importantly, you want to have the contact information for your insurance company when its time to report the claim. Keep that information saved in your phone so you’re not having to search for it later.

3. Take photos of the damage to your property.

When its safe to return to the property or leave your home, begin taking photographs of all of the damage to your property. Do not begin throwing away damaged property before you have had an opportunity to photograph the damage.

4. Document living expenses, debris removal, and store damaged property.

You may be covered for alternative living expenses in case your home becomes unlivable. Save receipts for food, gas, and lodging so you can seek reimbursement from your insurance company.

If you have need to spend money to remove fallen trees or fencing around your home, you may be able to seek reimbursement up to certain amount. Keep your receipts organized and readily available to your insurance claims adjuster.

Be sure not to throw away any personal property that gets damaged by the storm. Instead, store them in a dry and safe location on your property for you insurance company to inspect it. You can also try placing certain items in garbage bags until your insurance adjuster inspects the damaged items.

5. Protect your home from further damage

After your property becomes damaged by the storm, its important to protect the property from more damage by making reasonable and necessary repairs. If your roof is leaking, have a tarp placed over the roof so it does not continue to leak during the several weeks and months your insurance adjuster spends investigating your damage. Your insurance company will not pay you for any damages caused by your failure to protect the property from further damage.